By 2025, generic drugs accounted for over 90% of all prescriptions filled in the United States, yet made up just 23% of total drug spending. That’s not a mistake. It’s the result of decades of deliberate policy choices - and it’s not the same anywhere else in the world.

Why Generics Matter More Than You Think

Generic drugs aren’t cheap knockoffs. They’re identical in active ingredient, dosage, safety, and effectiveness to their branded counterparts. The only difference? Price. And that’s where governments step in. Across the globe, healthcare systems are under pressure. Aging populations, rising chronic diseases like diabetes and heart failure, and stagnant public budgets mean every dollar spent on medicine counts. Generic drugs offer a simple solution: replace expensive brand-name pills with FDA- or EMA-approved versions that cost a fraction of the price. The numbers speak for themselves. The World Health Organization estimates that well-run generic substitution programs can slash pharmaceutical spending by 30% to 80%. In the U.S. alone, Medicare saved $142 billion in 2025 thanks to generics - that’s $2,643 saved per beneficiary. In Europe, generics make up 65% of prescriptions but only 22% of total drug costs. That’s the power of competition.The U.S. Model: High Volume, Low Prices, Big Savings

The United States runs the most aggressive generic market in the world. The FDA’s Orange Book lists over 11,300 approved generic drugs as of late 2024. About 90.1% of all prescriptions are filled with generics - higher than Canada (88.7%), the UK (84.2%), or Germany (79.6%). How? Two things: strong incentives and market structure. The Hatch-Waxman Act of 1984 created the modern generic approval system, letting companies skip expensive clinical trials if they prove bioequivalence. Then came the Competitive Generic Therapy (CGT) designation - a fast-track for drugs with little or no competition. In August 2025, Zenara Pharma got CGT approval for its generic version of Sertraline, cutting the approval time from 24 months to under 10. But here’s the twist: even with such high generic use, the U.S. still pays more for drugs than any other country. Why? Because brand-name drugs are priced sky-high. Generics keep the system from collapsing, but they don’t fix the root problem. Public-sector net prices for prescriptions are still 18% lower than in peer countries - thanks to Medicare and Medicaid negotiating power, not because generics are cheaper than elsewhere. They’re just used more.Europe’s Paradox: Harmonized Rules, Fragmented Prices

The European Union has one of the most complex systems. The European Medicines Agency (EMA) approves generics for all 27 member states. But once approved, each country sets its own price. That creates a wild mismatch. Identical generic pills - same manufacturer, same batch - can cost 300% more in one country than another. In Germany, mandatory substitution laws mean pharmacists must switch patients to generics unless the doctor says no. In Italy, only 67% of prescriptions are filled with generics, even though the economy is similar. Why? Cultural resistance, lack of pharmacist incentives, and confusing reimbursement rules. The Netherlands takes a different approach. It uses external reference pricing, meaning it looks at prices in France, Belgium, the UK, and even Norway - a non-EU country - and sets its own price lower than all of them. It’s clever, and it works. But it also creates tension. Manufacturers complain they’re being forced to sell at a loss. Patients get cheaper drugs. The system works - but barely.China’s Nuclear Option: Volume-Based Procurement

China didn’t try to negotiate. It went all-in on bulk buying. In 2018, it launched Volume-Based Procurement (VBP), a centralized auction system where hospitals bid for the lowest price on generic drugs. The winner gets to supply 80% of the country’s demand. The results? Average price drops of 54.7%. In some cases - like the blood thinner rivaroxaban - prices fell by 93%. By 2025, China was producing over half of the world’s generic pills by volume. But there’s a dark side. Many manufacturers are losing money. A 2025 survey by the China Generic Pharmaceutical Association found 23% of companies were operating at a negative margin on VBP contracts. That leads to shortages. In 2024, Amlodipine - a common blood pressure drug - disappeared from 12 provinces for six to eight weeks. Patients were forced to switch brands or go without. And now, China is doubling down. In January 2026, the next phase of VBP will include 150 more drugs, with winning bids expected to be 65% below current prices. Experts warn this could drive smaller manufacturers out of business - and hurt long-term supply.

India: The Pharmacy of the World

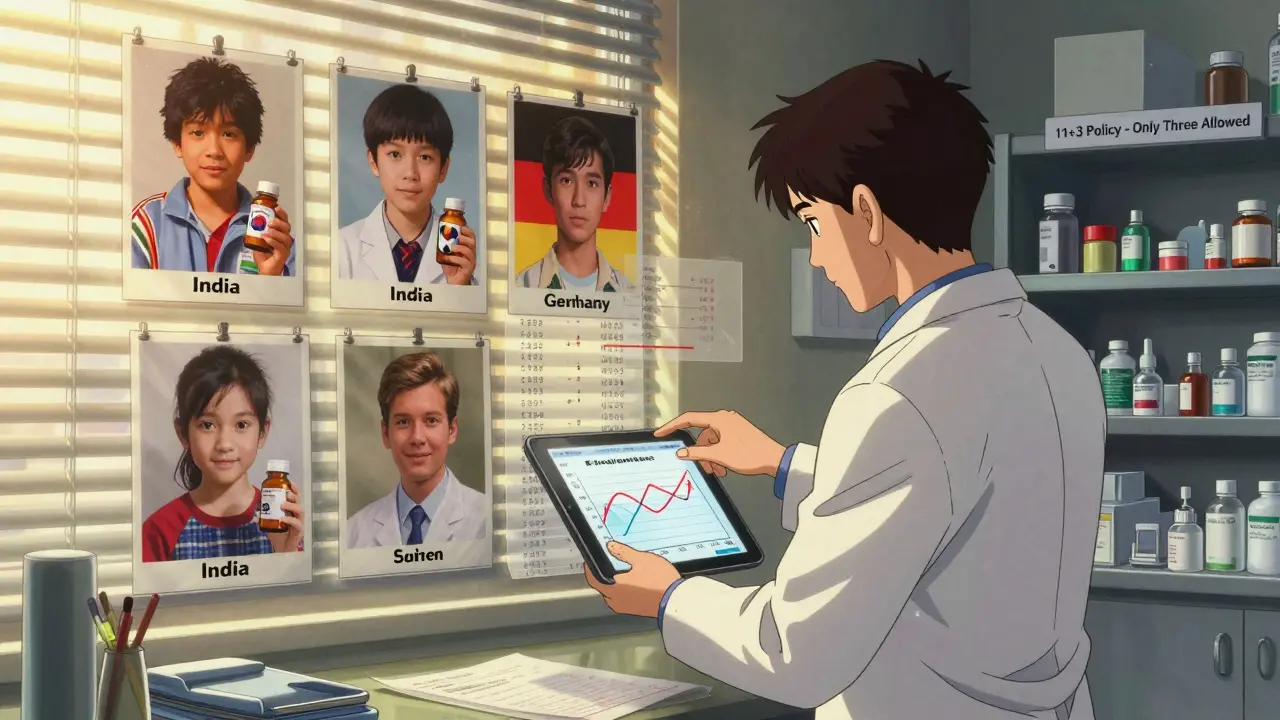

India makes 20% of the world’s generic drugs by volume. It’s not the richest market, but it’s the most prolific. Why? Two reasons: cheap labor and bold laws. Section 84 of India’s Patents Act allows the government to issue compulsory licenses - basically, saying, “We need this drug, so we’re letting local companies make it, even if the patent hasn’t expired.” This led to life-saving HIV and cancer drugs being sold for pennies in Africa and Latin America. But quality control is a constant struggle. Between 2022 and 2024, the U.S. FDA issued 17% more warning letters to Indian generic manufacturers over data integrity issues. Some labs were falsifying bioequivalence results. The Access to Medicine Foundation warns that if quality slips, global trust in Indian generics could collapse - and with it, access for millions.South Korea: The Tightrope Walk

South Korea tried something new in 2020: the “1+3 Bioequivalence Policy.” The idea? Only allow three generic versions of any drug to enter the market. The first one gets full pricing. The next two get slightly less. Any others? They’re blocked. It worked - sort of. Between 2020 and 2024, redundant generic entries dropped by 41%. But new generic launches fell by 29%. Fewer companies meant less competition, which meant slower price drops. The government also tied pricing to quality. Generics that passed strict bioequivalence tests got 53.55% of the brand price. Those that didn’t? Only 38.69%. It’s smart economics - but it also discouraged small players from entering.The Hidden Cost: Quality vs. Price

Every country wants cheaper drugs. But no one wants dangerous ones. The FDA’s import alerts for quality violations jumped from 1,247 in 2020 to 2,183 in 2024. Most came from India and China. The issue? Inconsistent manufacturing, missing data, and sometimes, outright fraud. Patients don’t know the difference between a safe generic and a risky one. Pharmacists can’t tell. Regulators are overwhelmed. The WHO recommends a minimum 15-20% gross margin for generic manufacturers. Why? Because if a company can’t make money, it cuts corners. It skips tests. It uses cheaper ingredients. It moves production to unregulated factories. In the U.S., patient satisfaction with generics is high - 78% on Reddit forums. But 63% complain about insurance formularies that charge higher copays for generics than brand-name drugs. Why? Pharmacy Benefit Managers (PBMs) often get kickbacks from brand companies. So even when a cheaper generic is available, your plan makes you pay more.

What’s Next? The Next Wave of Expirations

Between 2025 and 2030, $217-236 billion in branded drug sales will lose patent protection. That’s a massive opportunity for generics. But only if policies keep up. The U.S. Inflation Reduction Act will let Medicare negotiate prices on 10-20 high-cost drugs per year starting in 2028. That could force brand companies to lower prices - or see their sales collapse. It might also speed up generic adoption. The EU’s new Pharmaceutical Package, expected in late 2025, aims to shorten generic approval times by 12-15%. It’s a step forward, but still doesn’t fix the pricing chaos. Meanwhile, manufacturers are consolidating. There were 3,500 generic drug makers globally in 2025. By 2030, McKinsey predicts only 2,200 will survive. The rest? They’ll be bought out or go bankrupt.What Works? What Doesn’t?

There’s no single best model. But some patterns stand out:- Do: Set clear bioequivalence standards (80-125% AUC and Cmax). Make sure generics are truly interchangeable.

- Do: Educate doctors and pharmacists. When they trust generics, patients trust them too. Studies show education boosts generic use by 22-35%.

- Do: Give manufacturers a fair margin. No one makes quality medicine at a loss.

- Don’t: Let price cuts go too far. China’s 93% drops created shortages. South Korea’s 1+3 rule slowed innovation.

- Don’t: Ignore quality oversight. The FDA’s rising warning letters are a red flag.

- Don’t: Let PBMs or insurers punish patients for choosing generics.

Final Thought: Generics Are a Tool - Not a Cure

Generic drugs aren’t magic. They don’t fix broken healthcare systems. But they’re the most powerful tool we have to make medicine affordable without sacrificing safety. The countries that succeed are the ones that treat generics like public infrastructure - not just a cost-cutting trick. They invest in regulation. They reward quality. They protect supply chains. And they never let price be the only thing that matters. The next decade will test that balance. Will we choose cheap drugs - or safe, reliable ones? The answer will decide whether millions can afford to live - or just survive.Are generic drugs really as safe as brand-name drugs?

Yes, if they’re approved by a reputable regulator like the FDA, EMA, or WHO-prequalified agency. Generics must prove they deliver the same amount of active ingredient into the bloodstream at the same rate as the brand-name drug. This is called bioequivalence. The FDA requires generics to meet the same strict manufacturing standards as brand-name drugs. The only differences are in inactive ingredients - like fillers or dyes - which don’t affect how the drug works.

Why do some people say generics don’t work as well?

For most drugs, this is a myth. But for drugs with a narrow therapeutic index - like warfarin, lithium, or some epilepsy medications - tiny changes in blood levels can matter. In rare cases, poorly made generics or switching between multiple generic brands can cause issues. That’s why some doctors prefer to keep patients on the same brand or generic version. But this isn’t about generics being inferior - it’s about consistency. Most patients switch without any problem.

Why are generic drugs cheaper if they’re the same?

Brand-name companies spend billions on research, clinical trials, and marketing. Generics don’t. Once a patent expires, other manufacturers can copy the drug without repeating expensive studies. They just need to prove it works the same way. That cuts costs dramatically. Manufacturing is also cheaper in countries like India and China, where labor and regulation costs are lower. Competition among multiple generic makers drives prices down further.

Do all countries approve generics the same way?

No. The U.S. and EU have strict, science-based systems. India and China have faster approvals but have faced quality issues. Some countries, like South Korea, add extra rules - like limiting how many generics can enter the market. Others, like the Netherlands, use foreign prices to set their own. There’s no global standard, which is why a generic made in India might be approved in the U.S. but rejected in Japan.

Can I trust generics made in India or China?

Many are safe and high-quality. The FDA inspects over 3,000 manufacturing sites globally each year - half of them in India and China. While there have been violations, most facilities meet U.S. standards. The key is whether the drug is sold in your country’s regulated market. If it’s approved by your national health authority, it’s been checked. Avoid buying generics online from unverified sellers - that’s where fake or substandard drugs enter the system.

Will generic drug prices keep falling?

In the short term, yes - especially with policies like China’s VBP or the EU’s new reforms. But long-term, prices may stabilize. As competition shrinks (fewer manufacturers), and quality demands rise, margins will need to cover real costs. If prices drop too far, manufacturers leave the market - leading to shortages. The goal isn’t the cheapest possible drug - it’s a reliable, safe, and consistent supply.

Ashley S

Why are we even pretending this is a win? My copay for generic sertraline is $45. The brand is $40. PBMs are laughing all the way to the bank.

Jeane Hendrix

Honestly, I’ve been on generics for years and never had an issue-but I do notice the pill color changes every few months. It’s weird. I think it’s the filler, right? Like, the active ingredient’s the same, but the ‘personality’ of the pill changes? I don’t know if that’s a thing, but it feels like it is. Also, why do some have weird tastes? Like, why does my generic metformin taste like burnt plastic? I know it’s not the drug, but… why??

Mukesh Pareek

China’s VBP model is a textbook case of predatory pricing masquerading as public health policy. When you force manufacturers into negative-margin contracts, you’re not lowering costs-you’re externalizing risk onto the supply chain. The 93% price drop on rivaroxaban? That’s not innovation-it’s a regulatory shell game that guarantees future shortages. And let’s not pretend India’s ‘compulsory licensing’ is ethical; it’s intellectual property theft wrapped in humanitarian rhetoric. The WHO’s 15-20% margin guideline exists for a reason: without profit, there’s no incentive for GMP compliance. Quality erosion isn’t a bug-it’s a feature of this system.

Rachel Wermager

Everyone’s missing the real issue: bioequivalence thresholds. The 80-125% AUC/Cmax range is archaic. For drugs with narrow therapeutic indices-warfarin, digoxin, phenytoin-it’s a gamble. The FDA doesn’t require within-subject variability testing for generics, which means two ‘bioequivalent’ generics might have wildly different PK profiles in the same person. That’s not science-it’s statistical loophole exploitation. And yet, we’re letting pharmacists switch patients between them like they’re swapping toothpaste brands. This is how medication errors happen.

Tom Swinton

Okay, I just want to say-this is the most important thing we’re not talking about: the people who make these drugs. The factory workers in Hyderabad, the chemists in Shanghai, the quality control inspectors in Ohio-they’re not faceless robots. They’re moms and dads and cousins and uncles who show up every day to make sure the pill you take doesn’t kill you. And when we demand $0.02 pills, we’re not just hurting corporations-we’re squeezing the life out of real people trying to do good work under impossible pressure. So yeah, generics save money-but let’s not pretend that saving money is the only thing that matters. Humanity matters too.

Leonard Shit

lol at the ‘1+3 bioequivalence policy’-so south korea basically said ‘we’re tired of your generic drama’ and slapped a cap on it? genius. now we have less competition, slower price drops, and everyone’s just… chillin’? i mean, if you’re gonna regulate innovation out of existence, at least own it. also, why is everyone surprised that when you make it impossible to profit, people stop making stuff? capitalism isn’t a suggestion, folks.

Saylor Frye

It’s funny how Americans treat generics like some kind of moral victory while still paying the highest prices on earth. We’ve got the most generics, the most regulation, and the most corporate capture. It’s like we’re trying to win a race by running in circles.

Katie Schoen

My grandma switched from brand to generic for her blood pressure med and her BP spiked. She panicked. Her doctor said, ‘it’s the same drug’-but she didn’t believe it. So we stuck with the brand. I get the math, but people aren’t equations. Trust matters. Consistency matters. And if we keep treating patients like data points, we’re gonna lose them.

Tiffany Adjei - Opong

Wait-so the FDA inspects 3,000 sites a year, half in India and China, and you’re telling me the problem is ‘quality erosion’? That’s not the problem. The problem is that we’ve outsourced our entire drug supply chain to countries with zero accountability, then act shocked when things go wrong. Also, PBMs get kickbacks? No one’s surprised. But why do we keep pretending this system isn’t rigged? The answer isn’t more generics-it’s breaking up the PBM-monopoly and forcing transparency. But that’s too hard, right? So we blame the pills instead.

Lily Lilyy

Every person who reads this should feel proud. We’re living in a time when millions around the world can afford life-saving medicine because of the quiet, unglamorous work of scientists, regulators, and factory workers who refuse to let profit decide who lives and who dies. This isn’t just about drugs-it’s about dignity. Keep pushing for fairness. Keep demanding quality. And never forget: access to medicine is a human right, not a privilege.