Buying generic drugs shouldn’t feel like a financial gamble. Yet for millions of Americans paying out-of-pocket, the price tag on a 30-day supply of metformin or lisinopril can jump from $4 to $40-or more-depending on which pharmacy you walk into. That’s where coupon and discount card programs come in. They’re not insurance. They’re not government aid. But for people without coverage or stuck in high-deductible plans, they’re often the only thing standing between them and skipping a dose.

How These Programs Actually Work

Think of discount cards like a bulk-buying club for prescriptions. Companies like GoodRx, NeedyMeds, and Blink Health negotiate directly with pharmacies and drug manufacturers to get lower prices on generic medications. They don’t pay for your drugs. Instead, they get paid a small fee by the pharmacy when you use their card. That’s why you can walk into any participating pharmacy, hand over a printed card or show the barcode on your phone, and get a discount right away.

There’s no sign-up. No personal info. No waiting for approval. Just present the card, and the pharmacy runs the price through their system. If the discount card price is lower than your cash price or even your insurance copay, you pay the lower amount. Simple.

Walmart started this trend back in 2006 with its $4 generic program. Today, most major chains-Target, Kroger, Costco-still offer a handful of generics at $4 for a 30-day supply or $10 for 90 days. But those lists are limited. What if you need a drug that’s not on the list? That’s where third-party cards like GoodRx fill the gap.

Where You’ll Save the Most

These programs work best on generic drugs. Period. A 2022 study in Circulation: Cardiovascular Quality and Outcomes looked at heart failure medications and found that patients using discount cards saved an average of 65% on generic-only regimens. For example:

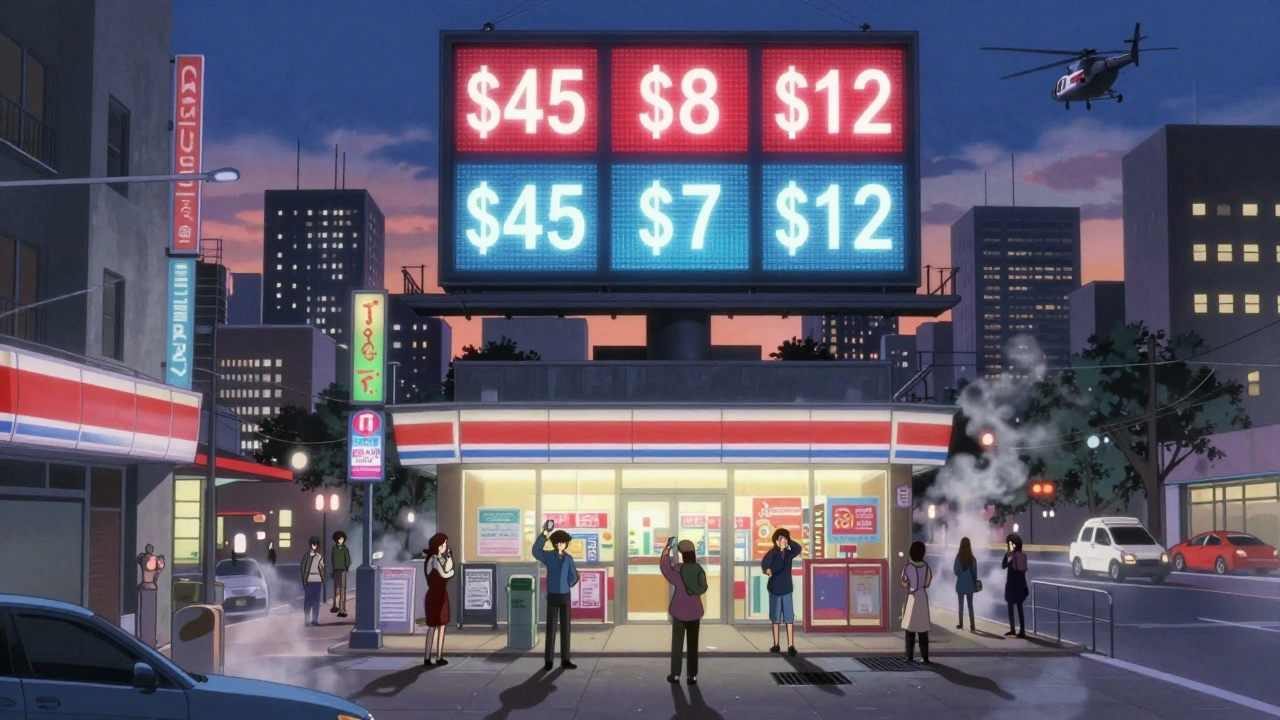

- Lisinopril (blood pressure): $4-$8 with GoodRx vs. $45 cash

- Metformin (diabetes): $3-$10 with discount cards vs. $50+ cash

- Atorvastatin (cholesterol): $5-$12 with cards vs. $60+ cash

One Reddit user saved $87 in a single month on their cholesterol meds using GoodRx. Another saved $42 on levothyroxine just by switching from their local pharmacy’s cash price to a card. These aren’t rare cases. They’re the norm for generics.

But here’s the catch: brand-name drugs? Not so much. The same study showed that when even one brand-name drug is added to the mix-like an SGLT2 inhibitor for diabetes-the discount drops to around 10%. Suddenly, that monthly cost jumps to $1,200-$1,500. Discount cards don’t fix broken pricing systems. They just help you avoid the worst of it on generics.

Which Cards Actually Work?

Not all cards are created equal. Here’s what the data says about the top players:

| Program | Best For | Discount Range | Pharmacies Covered | Extra Features |

|---|---|---|---|---|

| GoodRx | Most generics, nationwide | Up to 85% | Over 70,000 | Price comparison tool, telehealth, free shipping |

| Blink Health | Mail-order, bulk refills | Up to 80% | Partner pharmacies only | Free delivery, 90-day supplies |

| NeedyMeds | Low-income, patient assistance | Varies | Over 25,000 | Links to free drug programs, financial aid guides |

| Walmart $4 Program | Core generics only | $4 (30-day), $10 (90-day) | Walmart stores only | No app needed, fixed pricing |

GoodRx is the most widely used because it covers the most pharmacies and shows real-time prices across multiple locations. Blink Health is great if you’re willing to order online and wait a few days for delivery. NeedyMeds is the best starting point if you’re struggling financially-it connects you to free or low-cost programs you might qualify for.

The Hidden Catch: Price Variability

Here’s where things get messy. The same drug, at the same pharmacy, can cost $15 with one card and $42 with another. Why? Because each card negotiates different deals with different pharmacy chains. A card that gives you $3 for metformin at CVS might charge $25 at Walgreens. And vice versa.

That means you can’t just pick one card and forget it. You have to compare. For each prescription, you need to check at least two or three apps. That’s not hard if you’re taking one medication. But if you’re managing diabetes, high blood pressure, and cholesterol-all on generics-that’s 30 minutes of price-checking every month. One user on Reddit wrote: “I spent two hours last week trying to find the cheapest price for my three meds. I almost gave up.”

And it’s not just cards. Sometimes, your insurance copay is lower than the discount card price. That’s why pharmacists are now trained to check all three: insurance, cash, and discount card. Ask them. Always. Don’t assume your card is the best deal.

Who Benefits the Most?

These programs were built for people without insurance. But they’re also a lifeline for people with high-deductible health plans (HDHPs). In 2022, 43% of U.S. workers were enrolled in HDHPs. That means you pay 100% of your drug costs until you hit your deductible-sometimes $2,000 or more. For someone early in the year, a $40 prescription for metformin is a real barrier.

Studies show people who believe generics are just as effective as brand names are three times more likely to use these programs. That’s not just about money-it’s about trust. If you think a generic won’t work, you won’t bother trying to save on it. But the science is clear: generics are identical in active ingredients, strength, and effectiveness. The only difference is the price.

What Doesn’t Work

Don’t expect discount cards to help with brand-name drugs. They won’t. Not meaningfully. Even with a 10% discount, drugs like Ozempic or Jardiance still cost hundreds of dollars a month. These programs don’t fix the root problem: drug manufacturers set sky-high prices, and PBMs (pharmacy benefit managers) profit from the mess.

Also, don’t rely on them if you’re on Medicare Part D. Many discount cards can’t be used with Medicare, and some pharmacies won’t accept them at all. Medicare already has its own pricing structure, and using a discount card might even trigger a penalty if you’re in the coverage gap.

And forget about using them for specialty drugs-insulin, cancer meds, autoimmune treatments. These aren’t covered by standard discount cards. You’ll need manufacturer assistance programs, not a coupon.

How to Use Them Like a Pro

Here’s a simple system that works:

- Before filling any prescription, open GoodRx and enter your drug name and dosage.

- Look at the prices at nearby pharmacies. Sort by lowest price.

- Check Blink Health for mail-order options-if you’re okay waiting a week.

- Ask your pharmacist: “What’s the cash price? What’s the price with this card?”

- If you’re on insurance, ask: “Is the card price lower than my copay?”

- Print the coupon or show the app. Pay the lowest price.

Do this every time. Even if you’ve used the same card before. Prices change daily. A drug that was $5 last week might be $12 this week. It’s not magic. It’s math.

The Bigger Picture

These programs are a band-aid on a broken system. They help people survive, but they don’t fix why drugs cost so much in the first place. The FTC is investigating whether pharmacy benefit managers are manipulating prices to inflate profits. Some PBMs charge pharmacies fees just to accept discount cards, then share part of that fee with the card company. It’s a loop that benefits nobody but the middlemen.

Still, for now, they’re the best tool we have. And if you’re paying cash for generics, you’re leaving money on the table. Millions of people use these cards every day. You can too.

Start with one drug. Compare the prices. Save $20. Then do it again next month. Over a year, that’s hundreds. That’s groceries. That’s gas. That’s peace of mind.

Are discount cards the same as insurance?

No. Discount cards are not insurance. They don’t cover your drugs. They don’t pay anything. They just give you access to pre-negotiated lower prices at pharmacies. You pay out-of-pocket every time, but it’s usually much cheaper than the regular cash price.

Can I use a discount card with Medicare?

Usually not. Most Medicare Part D plans don’t allow you to combine their pricing with discount cards. Some pharmacies may let you choose the lower of the two, but many won’t accept the card at all if you’re on Medicare. Always check with your pharmacist before using one.

Do I need to sign up or give personal info?

No. You don’t need an account, email, or ID. Just download the app or print a card. When you get to the pharmacy, hand it over. No tracking. No data collection. It’s completely anonymous.

Why is the price different at every pharmacy?

Each pharmacy negotiates its own pricing deals with drug distributors and discount card companies. One pharmacy might have a better deal with GoodRx, another with Blink Health. That’s why you have to compare prices-even within the same city.

Can I use these for brand-name drugs like Ozempic?

Not really. Discount cards offer only about 10% off brand-name drugs, which still leaves you paying hundreds or thousands a month. For drugs like Ozempic, look into manufacturer coupons or patient assistance programs instead. Those are designed specifically for high-cost brand medications.

How often should I check prices?

Every time you refill. Prices change weekly, sometimes daily. A drug that was $8 last month could be $15 this month. Don’t assume your old coupon is still the best deal. Always compare.

What if my pharmacy says the card doesn’t work?

Ask them to call the pharmacy’s corporate help line or check the card’s website directly. Sometimes the system just needs to be reset. Or the pharmacy might not be in the network for that specific card. Try another card or another location. There are over 70,000 participating pharmacies in the U.S.

Carolyn Ford

Wow. Just... wow. You actually think people don't know this already? Like, we're not stupid. We've been using GoodRx since 2017. You wrote a 2,000-word essay on how to not get ripped off by pharmacies... and called it 'insight'? This isn't a revelation. It's a Yelp review for your local CVS.

Alex Piddington

Thank you for this comprehensive overview. It is important to recognize that while discount programs serve as a valuable stopgap, they do not address the systemic issues within pharmaceutical pricing. I encourage all readers to advocate for policy reform alongside personal cost-saving measures. The dual approach ensures both immediate relief and long-term change.

Libby Rees

I’ve been using NeedyMeds for my thyroid meds since last year. It’s not flashy, but it works. No app. No login. Just a printed sheet I keep in my wallet. I save about $30 a month. That’s two tank fills of gas. Not bad for a free tool.

Pavan Kankala

Let me guess - you’re one of those people who thinks Big Pharma is just ‘bad’ and discount cards are the ‘people’s solution.’ Wake up. These programs are orchestrated by the same PBMs who jack up prices. GoodRx? Owned by a hedge fund. Blink Health? A subsidiary of a private equity firm. They don’t care if you live or die - they care if you click their ad. This is a trap disguised as charity.

Martyn Stuart

I’d like to add a critical point: always check the pharmacy’s own loyalty program. Some independent pharmacies offer deeper discounts than GoodRx - especially if you’re a regular. Also, don’t overlook community health centers - they often have sliding-scale pricing for generics, even if you’re not low-income. And yes, always ask the pharmacist - they’re usually more helpful than you think.

Shofner Lehto

I’ve been using this exact system for 3 years. Every refill. Every time. I’ve saved over $1,200 in that time. It’s not glamorous. It’s not exciting. But it’s real. And if you’re paying full price because you’re ‘too busy,’ you’re just choosing to pay more. Do the 5 minutes. Your future self will thank you.

Yasmine Hajar

I used to skip my meds because I couldn’t afford them. Then I found GoodRx. I cried the first time I paid $5 for my blood pressure pill instead of $48. I’m not exaggerating - it changed my life. If you’re reading this and you’re scared to try, just do it. One card. One pharmacy. One month. You’ve got nothing to lose but overpriced pills.

Karl Barrett

There’s a deeper epistemological layer here: the commodification of health. Discount cards operate within a neoliberal framework where survival is contingent on individual optimization - price comparison, app usage, pharmacy hopping. We’re told to be ‘smart consumers,’ but the real problem is the absence of universal healthcare. These tools are survival tactics in a system designed to extract. We’re not just saving money - we’re resisting.

Jake Deeds

I mean, I’m glad you’re helping people save $20 a month on metformin... but honestly? You’re just enabling the system. If you really cared, you’d be out there protesting, not Googling coupons. It’s easier to use a card than to demand justice, isn’t it? I’m not judging... but I am disappointed.

Isabelle Bujold

One thing that’s rarely mentioned is that even within the same pharmacy chain, prices can vary by location - sometimes by as much as 40%. For example, a GoodRx coupon for atorvastatin might be $7 at the downtown store but $18 at the suburban branch, even though they’re both Walgreens. Always check the exact address, not just the city. I’ve learned this the hard way - drove 20 miles for a $12 savings only to find out the pharmacy had run out of the discounted stock. Always call ahead.

George Graham

This is the kind of post that reminds me why I still believe in communities like this. I’ve seen people skip meds because they think generics don’t work. I’ve seen elderly folks choose between food and insulin. This isn’t just about money - it’s about dignity. Thank you for making this clear, simple, and actionable. You didn’t just write a guide. You gave people back control.

John Filby

Just tried GoodRx for my zoloft - saved $41! 😊 I didn’t even know I could do this. Now I’m checking all my meds. This is like finding out you’ve been overpaying for coffee for 5 years. So easy. So stupid I didn’t do it sooner.