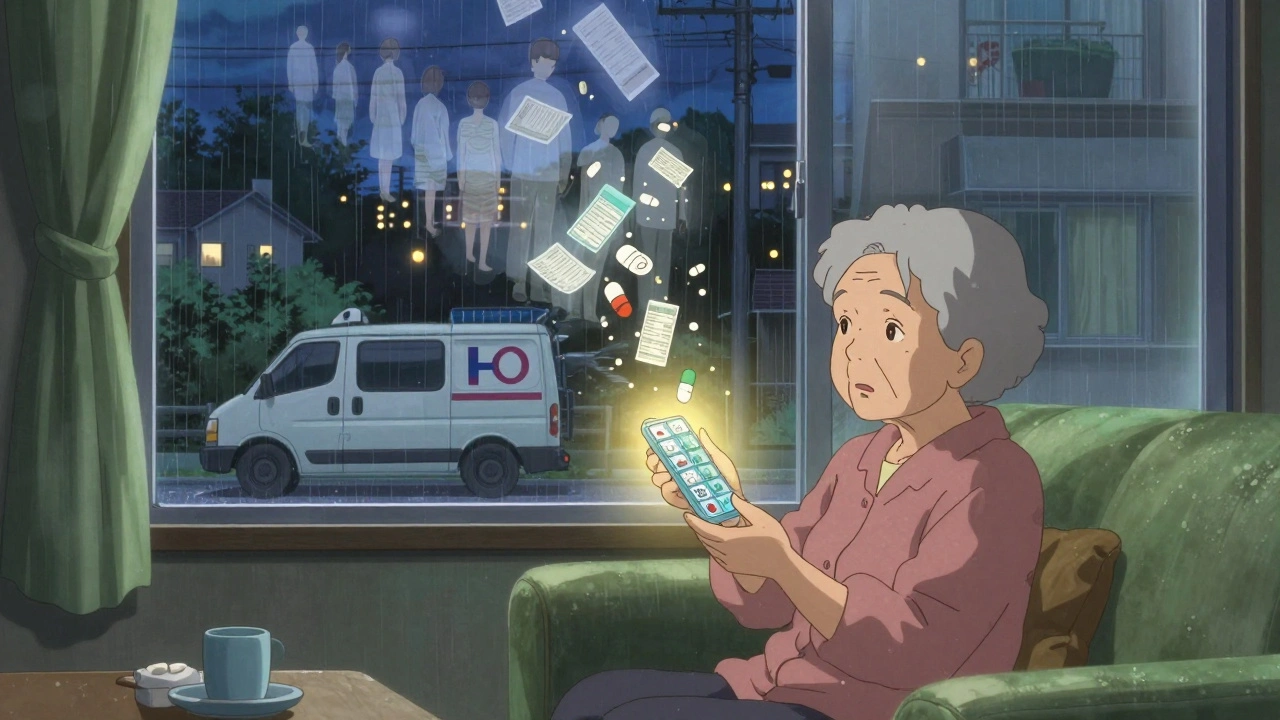

Managing multiple prescriptions can feel like juggling too many balls at once. You’ve got pills for blood pressure, diabetes, cholesterol, pain, and maybe even a specialty drug for something rare. Each one has its own refill date. Each one comes with its own copay. And every time you walk into the pharmacy, you’re paying again-even if you’ve already paid for the same medication last month. It’s exhausting. And worse, it’s expensive. The average Medicare beneficiary on a three-tiered plan pays 57.6% more per prescription out-of-pocket than those on simpler plans. That adds up fast. But there’s a proven way to cut down both the number of visits and the total amount you pay: medication synchronization.

What Is Medication Synchronization?

Medication synchronization, or med sync, is a free service offered by most major pharmacies that aligns all your chronic medication refills to one day each month. Instead of showing up four times a month for different pills, you show up once. All your prescriptions are ready. You pay one copay instead of four. And you’re far less likely to miss a dose. It’s not magic. It’s logistics. Pharmacists look at your entire list of medications-prescription and over-the-counter-and figure out how to bring all your refill dates together. That might mean giving you a small early refill on one, or a short fill on another, just to get everything synced up. It usually takes 1 to 3 months to fully set up, depending on your current refill cycles. The benefits are real. A 2023 analysis by Farmington Drugs showed that patients using med sync reduced their pharmacy visits by 60% or more. CMS data from 2020-2022 found that people enrolled in med sync had 23.6% fewer hospital admissions due to medication errors or missed doses. That’s not just saving money-it’s saving your health.How It Works: The Four-Step Process

Getting started is simple, but it requires a conversation. You can’t just sign up online. You need to talk to your pharmacist.- Enroll: Walk into your pharmacy and ask if they offer medication synchronization. Most do-CVS, Walgreens, Rite Aid, and independent pharmacies all have programs. Say you’re managing multiple chronic medications and want to reduce your visits and copays.

- Medication review: The pharmacist will pull up your full list, including any OTC meds, supplements, or herbal products. They’ll check for interactions, duplicates, or outdated prescriptions. This step alone can uncover problems you didn’t even know you had.

- Short fills: This is the trickiest part. If one of your meds is due in 10 days and another isn’t due for 45, the pharmacist may give you a smaller amount now so everything lines up. You might end up with a 15-day supply of one pill instead of 30. It’s temporary. It’s legal. And it’s the key to syncing everything.

- Monthly pickup: Once everything’s aligned, you’ll get a call or text every month letting you know your meds are ready. Pick them up on the same day. Pay one copay. Leave with everything you need for the next 30 days.

Why Copays Add Up-and How Syncing Helps

Think about it: if you take six chronic medications, and each is refilled every 30 days on a different day, you’re making six trips a month. That’s 72 trips a year. Each trip might cost you $10-$40 in copays, depending on your plan. That’s $720 to $2,880 a year just in copays-before you even factor in gas, time off work, or childcare. Med sync turns that into 12 trips a year. Same medications. Same doses. But now you’re paying one copay per month instead of six. That’s a 83% reduction in transactions. And because each copay is often lower when you’re on a synchronized plan (due to bulk refills), you could save even more. The NIH found that for every 10% increase in out-of-pocket costs, people take 2.3% fewer pills. That’s not just about money-it’s about survival. If you skip your blood pressure pill because you can’t afford the copay this month, you’re risking a stroke. Syncing your meds removes that choice.

What About Combination Pills?

Sometimes, the best way to reduce copays isn’t to sync refills-it’s to combine pills. A single tablet that contains both a blood pressure med and a cholesterol drug eliminates two separate copays entirely. Between 2018 and 2023, the FDA approved 127 new fixed-dose combination medications. These are especially common for diabetes, hypertension, and HIV. Ask your doctor if any of your meds can be switched to a combination pill. Not all drugs can be combined, but many can. MaxCareRx reported that patients using combination pills saw a 27% drop in missed doses because they had fewer pills to track. But here’s the catch: combination pills aren’t always cheaper. Sometimes the brand-name combo costs more than two generic pills. Your pharmacist can run a cost comparison using your insurance to show you exactly what’s cheapest.Watch Out for Copay Accumulators

If you use manufacturer coupons or copay cards-especially for specialty drugs-this is critical. Since 2017, many insurers have started using copay accumulator programs. These programs let your copay card reduce your out-of-pocket cost at the pharmacy… but they don’t count it toward your deductible or out-of-pocket maximum. That means you might think you’re saving $500 a month on your $600 drug, but your insurance doesn’t recognize that payment. So your deductible stays high. Next year, you’ll still be paying full price until you hit that deductible again. User ‘ChronicWarrior87’ on Reddit described it perfectly: “My $5,000 coupon got voided. My monthly cost jumped from $50 to $650.” That’s not a glitch-it’s policy. Ask your pharmacist: “Does my plan use a copay accumulator?” If they say yes, ask if they can help you find an alternative funding program. Some drugmakers now offer direct patient assistance or mail-order discounts that bypass accumulators entirely.Specialty Drugs Are the Big Challenge

Specialty medications-like those for MS, rheumatoid arthritis, or cancer-make up less than 2% of all prescriptions but account for over half of total drug spending. These drugs often come with high copays and complex access rules. The good news? Many of them are eligible for copay maximizer programs. These programs let manufacturers apply their coupons directly to your insurance, reducing your cost without triggering accumulators. But you need to work with your pharmacy to set it up. Your pharmacist can call the drugmaker’s patient support line, apply for financial aid, or even arrange free samples while you wait for approval. Don’t assume you can’t afford it. Many patients get their specialty meds for $0 or under $10 a month with the right help.

Common Problems and How to Fix Them

Not every medication can be synced. Acute meds-like antibiotics or short-term painkillers-don’t belong in a monthly sync. And some plans don’t allow early refills. Here are the top three problems and how to solve them:- “My 90-day pill can’t be synced with my 30-day pills.” Ask for a partial fill. Your pharmacist can give you a 30-day supply now and a 60-day supply later to align dates. Medicare allows early refills up to 2 days before the 70% point of your last fill.

- “I ran out of pills during the sync-up period.” This happens in about 32% of cases, according to Trustpilot reviews. Ask for a bridge supply-a small emergency refill-while waiting for your meds to align. Most pharmacies will give you 5-7 days’ worth for free.

- “My insurance won’t let me sync.” Call your insurer. Ask if they cover med sync under your Part D plan. If they say no, ask for a coverage exception. Many plans approve it if you have three or more chronic conditions.

Who Benefits Most?

Med sync isn’t for everyone. But if you fit any of these profiles, it’s almost certainly worth it:- You take three or more maintenance medications daily

- You’re on Medicare Part D or a retiree drug plan

- You’ve missed a dose in the past six months

- You’ve been to the pharmacy more than twice a month

- You use a copay card or manufacturer assistance program

What to Do Next

Step 1: Make a list of every medication you take, including doses and refill dates. Step 2: Call your pharmacy and ask if they offer medication synchronization. Step 3: Schedule a 15-minute appointment with the pharmacist. Bring your list and your insurance card. Step 4: Ask: “Do you use copay accumulators? Can you help me find alternative funding for any specialty drugs?” Step 5: Wait 1-3 months. Then, enjoy your one-day-a-month pharmacy trip. You won’t get rich from this. But you’ll save hundreds a year. You’ll avoid hospital trips. And you’ll finally feel in control of your own health.Can I sync my prescriptions if I’m not on Medicare?

Yes. Medication synchronization is available to anyone taking multiple chronic medications, regardless of insurance type. Private insurers, Medicaid, and even some employer plans offer it. Ask your pharmacy-they’ll check your coverage for free.

Will my copay go up if I sync my prescriptions?

Usually not. In fact, most people pay less overall. While your copay per refill might stay the same, you’re paying fewer times per year. Some pharmacies even offer a discount for synchronized refills. Always ask: “Is there a lower copay for 90-day fills?”

What if my meds have different refill cycles (30-day vs. 90-day)?

Your pharmacist can use partial fills to align them. For example, if your blood pressure med is a 90-day supply and your diabetes med is 30-day, they might give you a 30-day supply of the blood pressure pill now, then a 60-day supply later. This gets everything synced to one monthly date. Medicare allows early refills up to 2 days before the 70% point of your last fill, which gives pharmacists room to adjust.

Do I have to go to the same pharmacy every month?

Yes. Med sync only works if all your prescriptions are filled at one pharmacy. That’s how the system tracks your refill dates and coordinates them. If you switch pharmacies, you’ll have to restart the entire process. Pick one you trust and stick with it.

Can I get my synced meds delivered instead of picking them up?

Some pharmacies offer mail delivery for synchronized prescriptions, especially for seniors or those with mobility issues. Ask if your pharmacy partners with a mail-order service. Some even deliver for free if you’re on Medicare. But if you use copay cards, delivery might not accept them-check first.

Michael Feldstein

Just did this last month after my mom had a scare from missing her blood pressure med. Took her to the pharmacy, we brought a list of everything she takes - even the gummies she swears are 'just vitamins.' The pharmacist spent 20 minutes with us, gave her a 10-day bridge supply for the one that was due too soon, and now everything’s synced to the first Friday of the month. One trip. One copay. I didn’t think it’d be this easy. Seriously, if you’re juggling meds, just go in and ask. No shame.

Heidi Thomas

Stop pretending this is revolutionary. This is basic pharmacy 101. If you can’t figure out how to manage multiple meds without a 'program' you probably shouldn’t be taking them. And don’t get me started on copay cards - those are just insurance loopholes for pharma to keep prices high. You want to save money? Switch to generics. Stop using coupons. And for god’s sake stop trusting pharmacists to fix your life.

Libby Rees

Medication synchronization is a well-documented practice in public health literature. It reduces medication non-adherence, which is responsible for approximately 125,000 deaths annually in the United States. The cost savings are not merely financial but also systemic, reducing emergency room visits and hospitalizations. I appreciate the detailed breakdown, especially the note about partial fills and Medicare guidelines. This is the kind of practical, evidence-based advice that should be widely promoted.

Dematteo Lasonya

I’ve been syncing my meds for two years now. I have lupus, diabetes, and high cholesterol. Before this, I was missing doses because I’d forget which pill was due when. Now I get a text every month like clockwork. I used to panic when I ran out of something. Now I just show up on my day and walk out with everything. It’s not glamorous. But it’s the quietest kind of freedom.

Gareth Storer

Oh wow, so the pharmacist is now your personal life coach? Next they’ll be holding your hand while you take your pills. And let me guess - they also remind you to drink water and stop eating cookies? This is what happens when healthcare becomes customer service. You don’t need a program. You need a brain.

val kendra

Y’all this is life-changing. I was paying $200 a month just in copays for my RA meds and my thyroid pill. I didn’t even realize I could ask for a 90-day fill or a combo pill. My pharmacist hooked me up with a manufacturer program that cut my cost to $10 a month. I cried in the parking lot. If you’re reading this and you’re overwhelmed - go to your pharmacy today. Don’t wait. Your future self will thank you.

Isabelle Bujold

One thing people often overlook is the emotional toll of managing multiple prescriptions. It’s not just about the money or the trips - it’s the mental load. The constant worry about refills, the guilt when you forget, the shame when you skip a dose because you can’t afford it. Medication synchronization doesn’t just streamline logistics - it reduces anxiety. I’ve seen patients go from terrified to calm after just one sync appointment. The pharmacy becomes a place of safety, not stress. And that’s worth more than any copay savings.

George Graham

My dad’s on six meds. He used to call me every week asking if he took his pills. Now he just picks them up on the 15th. He says it’s the first time in 10 years he’s felt like he’s got his health under control. I didn’t know this was even a thing until I saw it on Reddit. Thank you for sharing this. It’s the kind of info that should be in every doctor’s office.